Automated Liquidity Management for DeFi | Ditto Network

Streamline your DeFi liquidity with Ditto’s automated management solutions. Achieve seamless operations and enhanced capital efficiency today.

Streamlining DeFi with Liquidity Management Automation

In the rapidly evolving world of decentralized finance (DeFi), managing liquidity efficiently has become a cornerstone for protocols looking to ensure seamless operations and capitalize on market opportunities. Liquidity management automation is key to staying competitive, especially as the complexity of managing assets across multiple platforms increases.

Automated Market Makers (AMMs) have revolutionized DeFi by enabling token swaps through smart contracts, eliminating the need for human intervention. These AMMs rely on liquidity providers (LPs) who deposit tokens into liquidity pools and earn transaction fees in return. However, the process of manually monitoring and adjusting liquidity positions is time-consuming and often requires technical expertise. This is where automated liquidity management solutions, such as those offered by Ditto Network, come into play.

Why Liquidity Management Automation Matters

Managing liquidity manually can be challenging and error-prone, often resulting in missed opportunities and inefficiencies. Automated liquidity management, on the other hand, allows protocols and LPs to optimize their positions effortlessly. This not only reduces operational costs but also sweetens capital efficiency, enabling LPs to maximize returns while mitigating risks.

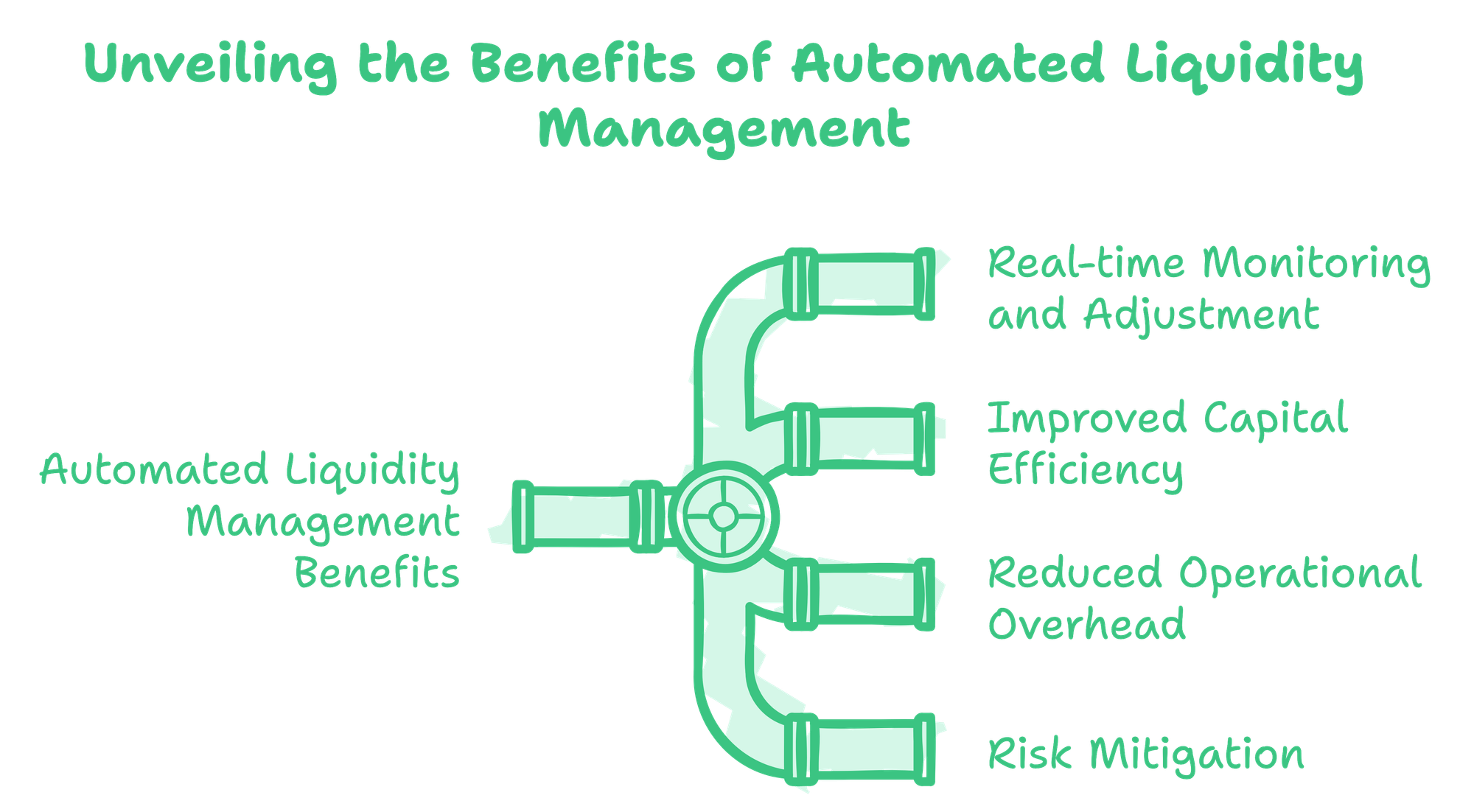

Key benefits of automated liquidity management include:

- Real-time Monitoring and Adjustment: Automation tools can continuously monitor the market and adjust liquidity positions accordingly, ensuring optimal range placement and fee collection.

- Improved Capital Efficiency: By automatically reallocating capital to the most productive pools, LPs can maximize their returns without tying up funds unnecessarily.

- Reduced Operational Overhead: Automation eliminates the need for constant manual intervention, allowing developers and operators to focus on building better products and services.

- Risk Mitigation: Automated systems can implement risk management strategies such as liquidation protection and emergency asset rebalancing to safeguard LPs' funds.

Ditto Network’s Approach to Liquidity Management Automation

Ditto Network is leading the charge in providing liquidity management automation through its Actively Validated Keeper Network (AVS). Leveraging EigenLayer integration and Symbiotic Ditto ensures that all automated workflows are executed with high security and reliability. This approach allows DeFi projects to build on top of Ditto’s infrastructure and benefit from its shared security model, improving the overall trust and resilience of their platforms.

Key Features of Ditto Network’s Liquidity Management Solutions

- Automated Market Adjustments: Ditto’s AVS continuously monitors liquidity pools and automatically repositions assets to optimize returns.

- Smart Contract Automation: By integrating smart contract automation, Ditto ensures that LPs can manage their positions without manual input, providing peace of mind and operational efficiency.

- Cross-Chain Functionality: Ditto’s infrastructure supports building scalable decentralized applications that require seamless cross-chain communication and liquidity management.

- Capital Efficiency for Stakers: The network enables stakers to restake their assets and extend security to additional applications, earning rewards while enriching overall network security.

- Robust Risk Management: Ditto’s automated systems can include modules like liquidation protection, which monitors asset health factors and triggers emergency repayments to prevent liquidation losses.

Automation for Developers: A Game Changer

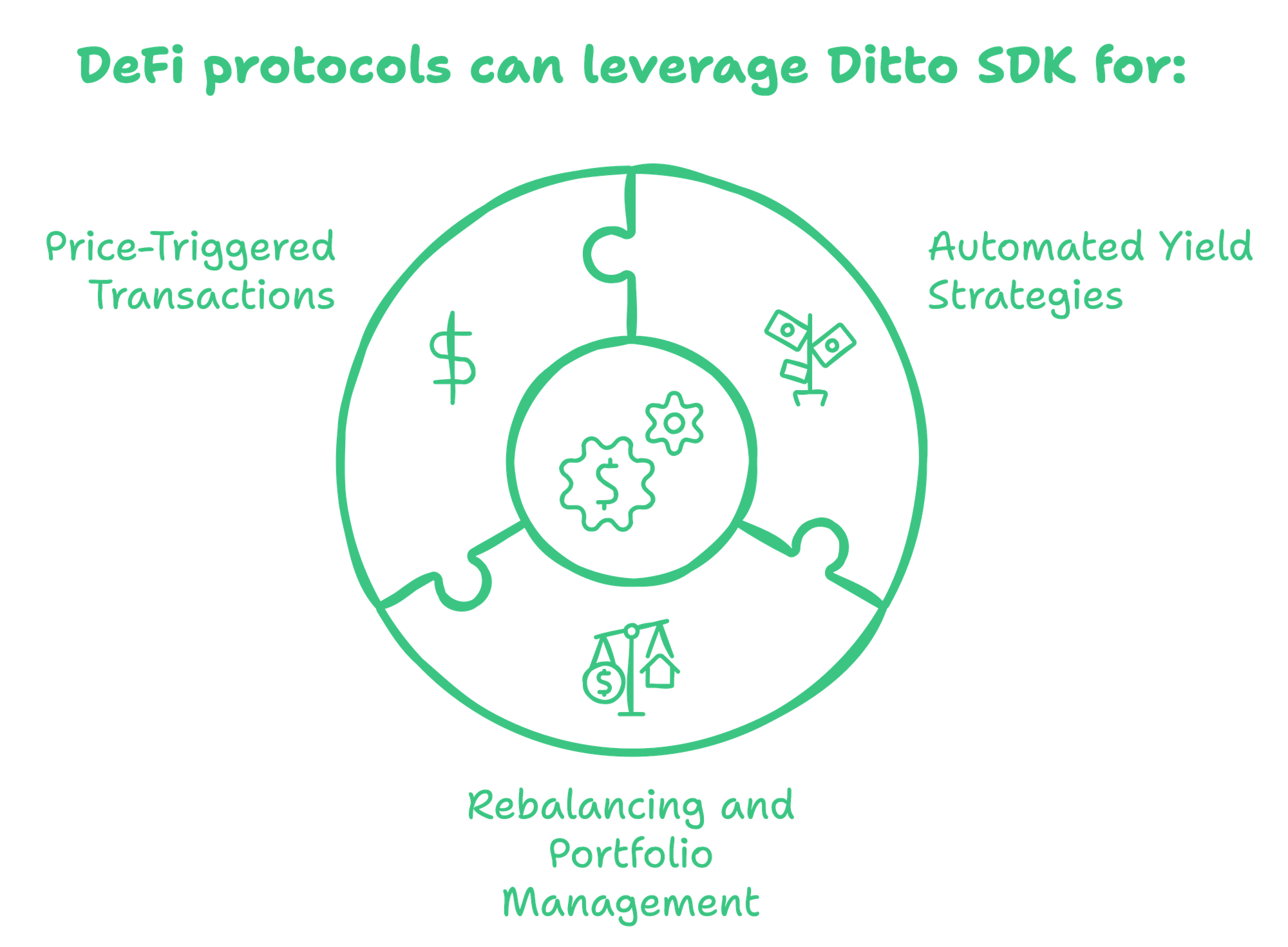

For developers looking to build scalable decentralized applications and integrate automated liquidity management into their projects, Ditto Network offers a suite of tools and SDKs designed to make implementation straightforward and efficient. This means that DeFi protocols can leverage Ditto’s infrastructure for:

- Automated Yield Strategies: Execute complex yield farming strategies without manual input.

- Rebalancing and Portfolio Management: Adjust positions based on market conditions for optimal performance.

- Price-Triggered Transactions: Set up smart contracts to execute trades based on predefined price points.

By simplifying the integration process, Ditto Network provides automation for developers, making it easier to deploy reliable and secure DeFi solutions without having to build everything from scratch.

How Ditto Network Stands Out

Ditto’s use of Symbiotic and EigenLayer integration ensures that all automated workflows are backed by Ethereum’s pooled security, providing robust economic guarantees and reliability. As an AVS, Ditto supports not only liquidity management but a wide range of automated functions that drive DeFi and dApps growth.

Why Choose Ditto for Liquidity Management Automation?

- Shared Security: Leveraging EigenLayer and Symbiotic’s restaking mechanism, Ditto offers high capital efficiency and secure, decentralized infrastructure.

- Flexible and Scalable Solutions: Ideal for protocols looking to scale their operations without sacrificing security.

- User-Friendly SDKs: Developers can access easy-to-use tools to automate smart contract interactions, reducing the time and effort needed for deployment.

- Economic Efficiency: Ditto provides stakers and LPs with higher capital efficiency, allowing them to earn more without additional financial input.

Let's dive deeper into why you should choose Ditto Network:

1. Operational Efficiency and Reduced Complexity

- Problem: Managing liquidity across multiple DEXs is labor-intensive and involves constant monitoring, manual rebalancing, and adjustments.

- Ditto Solution: Ditto’s liquidity management automation streamlines these tasks by automatically executing rebalancing and adjustments when set parameters are met. This reduces the need for manual oversight and allows teams to focus on core development and innovation.

2. Real-Time Adaptability

- Problem: DeFi markets are volatile and can experience rapid shifts, making it challenging for protocols to adapt quickly.

- Ditto Solution: Ditto ensures that protocols respond to real-time market changes efficiently. For example, if a token's price experiences sudden movement, Ditto’s automation can adjust liquidity pools to optimize yield and minimize losses, maintaining capital efficiency.

3. Enhanced Security with Decentralized Redundancy

- Problem: Centralized tools can create single points of failure, leaving protocols vulnerable to outages and security risks.

- Ditto Solution: Leveraging EigenLayer integration and Symbiotic, Ditto’s infrastructure distributes tasks across a decentralized network of operators. These operators risk slashing of their staked assets if they fail or act maliciously, ensuring an economic guarantee and reliable performance for users.

4. Customization and Flexibility

- Problem: DeFi protocols have unique requirements for liquidity management, such as needing automation based on specific market triggers.

- Ditto Solution: Ditto allows protocols to set custom parameters for automated actions, like price-based rebalancing or volume-triggered adjustments, ensuring that automation aligns with their strategies.

5. Simplified Advanced DeFi Strategies

- Problem: Implementing complex strategies, like multi-pool rebalancing or cross-chain liquidity management, can be resource-heavy and time-consuming.

- Ditto Solution: With automation for developers, Ditto offers pre-built modules that make integrating and executing advanced strategies simple and efficient. This reduces development time and optimizes capital usage.

6. Seamless Integration with Other DeFi Services

- Problem: DeFi protocols often need to coordinate liquidity management with interconnected services like lending platforms and yield aggregators.

- Ditto Solution: Ditto’s automation tools integrate with various DeFi services to ensure smooth operations and effective synergy, optimizing overall workflow and enhancing DeFi and dApps growth.

7. Developer-Friendly Tools

- Problem: Building and maintaining automation solutions from scratch requires extensive time, resources, and coding expertise.

- Ditto Solution: Ditto provides a user-friendly SDK that simplifies smart contract automation. Developers can create and implement custom workflows without extensive coding, enabling faster deployment and improved capital efficiency.

Conclusion

Liquidity management automation is essential for any DeFi protocol looking to maximize its potential. By automating key functions like asset rebalancing, liquidation protection, and smart contract executions, Ditto Network simplifies operations and improves capital efficiency. Through Symbiotic and EigenLayer integration, Ditto offers a robust, secure, and developer-friendly infrastructure that supports the growth and scalability of DeFi and dApps.