Ditto Execution Network (AVS): A Game-changer in Blockchain Automation

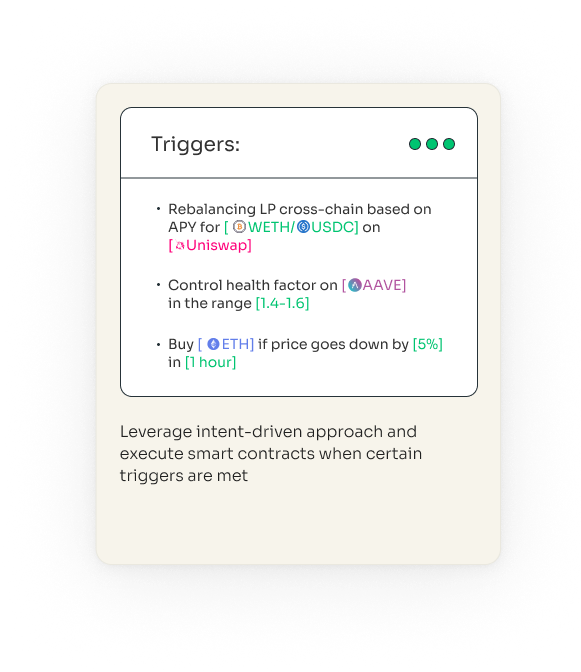

Introducing Ditto trustless execution layer for event-driven and invent-centric workflows.

Ditto Execution Network (AVS): A Gamechanger in Blockchain Automation

Introduction

In the rapidly evolving blockchain landscape, secure and efficient execution of workflows is paramount. Smart contracts, by nature, are self-executing contracts with the terms of the agreement directly written into code. However, they require external agents, or keepers, to enforce these conditions and trigger execution at the right moment. Ditto Network’s Actively Validated Keeper Network (AVS) emerges as a revolutionary solution, addressing the critical needs of trustless execution and economic guarantees. Leveraging Eigenlayer’s shared security, Ditto AVS ensures that all workflows are executed reliably and securely, setting a new standard in the industry.

Market Landscape and Competitors

The current market for blockchain automation and keeper networks includes notable players such as Gelato, Chainlink Automations, and Kee3pr. While these platforms offer automation services, they fall short in several key areas, particularly in terms of security and economic guarantees.

- Gelato: Primarily focuses on DeFi automation but lacks robust economic guarantees and relies on centralized control for managing the nodes and execution.

- Chainlink Automations: Known for its decentralized oracle services but has limited scope in comprehensive security assurances.

- Keep3r: Provides decentralized job execution but does not offer the same level of economic guarantees and compensation.

Ditto AVS stands out by offering a fully decentralized solution with disputes resolved through zk proofs, ensuring objective and transparent verification.

Why Ditto AVS is a Gamechanger

Trustless Execution and Economic Guarantees

Ditto AVS is built on the shared security model of Eigenlayer, which significantly enhances the trust and reliability of the network. This model allows for:

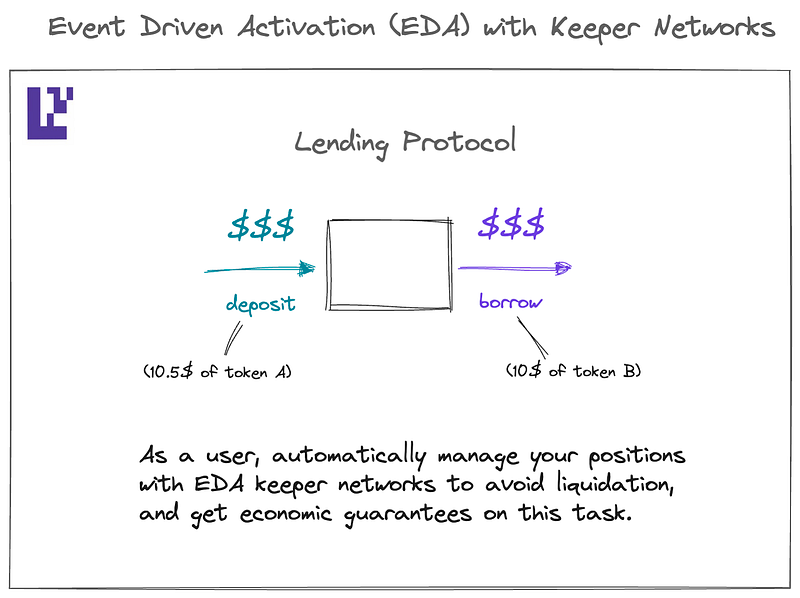

- Economic Guarantees: By leveraging the shared security of Eigenlayer, Ditto AVS can offer economic guarantees for execution based on the delegated stake of the operators. This ensures that all workflows are executed with financial backing, reducing the risk of failure.

- Slashing Mechanism: If a node operator fails to execute a workflow, a slashing mechanism compensates the automation users, ensuring accountability and reliability.

Enhanced Security with ZK Proofs

Ditto AVS employs zero-knowledge (zk) proofs to validate possibility of execution via storage slot verification. This approach provides:

- On-Chain Verification: As all workflows and the workload distribution are posted on-chain the system utilizes objective slashing via smart contract slashing resolution and compensation enforcement.

- Objective Dispute Resolution: The verification of the historic blockchain state happens via zk proofed described in the WhitePaper.

Flexibility and Scalability

Ditto AVS offers flexibility in terms of the level of security and economic guarantees for transactions:

- Customizable Security Levels: Users can choose the level of security based on their requirements. For instance, securing the $1M DCA strategy happens via setting appropriate execution reward amount working as a classic “injurance”. Selecting the top 50 node operators can provide ~$2M in economic guarantees, while the top 20 can offer $30M.

- Future Protocol Enhancements: Upcoming versions of the protocol will include features like aggregating signatures with workflow data to create a Merkle root, validating automation existence without requiring users to post data each time.

Use Cases and Applications

Dollar-Cost Averaging (DCA) Actions

Executing large transactions, such as swapping $1M every hour, requires high reliability. Ditto AVS’s compensation mechanism through slashing ensures that even if a node operator fails, the user can still be secured.

Time-Sensitive Actions

Swift actions like preventing collateral liquidation, minting new NFTs, or executing token trades in response to specific on-chain behaviors are critical. Ditto AVS ensures these actions are prioritized and fulfilled through Ethereum inclusion trust via EigenLayer, providing unmatched security and reliability.

Future Implications and Modules

Ditto Network is continuously developing new modules to enhance its capabilities:

- Leverage Positions: Execute leverage positions on decentralized exchanges in one click, optimized for the best interest rates.

- Liquidation Protection: Protect positions on platforms like Aave by automatically rebalancing and adding collateral based on health factor changes.

- Advanced Automation Tools: Future modules will include more sophisticated automation tools, further simplifying blockchain app development and asset management.

The Importance of Shared Security

Before the introduction of shared security by Eigenlayer, achieving such robust economic guarantees was not feasible. Locking hundreds of millions of dollars to provide these guarantees was inefficient and unattractive for operators. The shared security model transforms this landscape, making it possible for networks like Ditto Network to offer unparalleled security and efficiency.

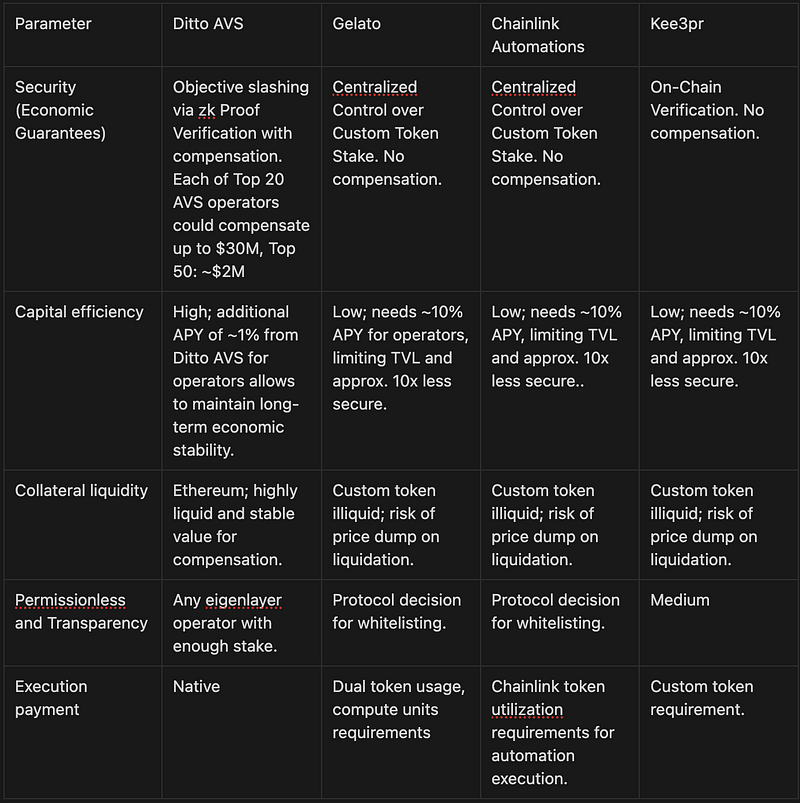

Key Data and Comparisons

Security Comparison Table

Key Advantages of Ditto AVS

- Open Participation: Anyone with sufficient restaked amount can become an executor.

- Compensation Mechanism: Users set the reward amount for automation, ensuring proportional compensation for missed executions.

- Shared Security Efficiency: High capital efficiency through Eigenlayer’s shared security, requiring only 1% of restaked amount annual yield, unlike Gelato or Chainlink, which require holding their own tokens.

- Objective Slashing: Uses zk proofs for storage slot validation, maintaining a permissionless and distributed system.

- Comprehensive SDK: Full account toolkit and SDK to leverage the execution layer and create sophisticated automations.

- Native yield for executors and native currency automation payments with no requirements on specialized protocol related token. Just ETH.

Incorporating these elements makes Ditto AVS not only a robust solution for current needs but also a future-proof platform ready to handle the evolving demands of blockchain automation.

Conclusion

Ditto AVS is poised to revolutionize the market for blockchain automation by providing a secure, reliable, and economically guaranteed execution network. Its advanced use of shared security, zk proofs, and customizable security levels makes it a superior alternative to existing solutions like Gelato, Chainlink Automations, and Keep3r which made either only reward incentives or just centralized services. As Ditto Network continues to innovate and expand its offerings, it is set to become a major player in the blockchain ecosystem, driving the future of decentralized and trustless execution.

For more information, visit our Documentation or simply Contact Us.

About Ditto Network

Ditto Network is a trustless actively validated keeper network (AVS) that runs event-driven workflows with economic guarantees of execution, leveraging shared security. In addition, Ditto offers various intent-centric automation modules and SDKs for founders and developers, introducing the future of embedded finance solutions in Web3.

The team is comprised of experienced web3 developers and professionals with backgrounds and previous exits in web3 from McKinsey, Uniswap, Nil Foundation, TrustWallet, NEAR, 3Commas, and PE/VC.

Website | X | Discord | Book a Call to Integrate Ditto to Your Project